Over 99% of businesses in Singapore are considered small and medium enterprises (SMEs). This dynamic small business setting highlights the importance of finding the right financing. This article shares essential tips for small business owners in Singapore to grasp what’s needed to get a small business loan.

It dives into the crucial aspects that lenders look for. These include your business’s legal status, revenue benchmarks, credit scores, and more. Knowing these requirements can boost your chance of getting the financial support to grow and thrive. This is crucial in the competitive arena of the small business loan in Singapore market.

Understanding Small Business Loan Requirements

Getting a small business loan in Singapore means knowing what various lenders need. It’s vital to grasp the unique requirements each lender has. This knowledge helps when you’re seeking funds for your business.

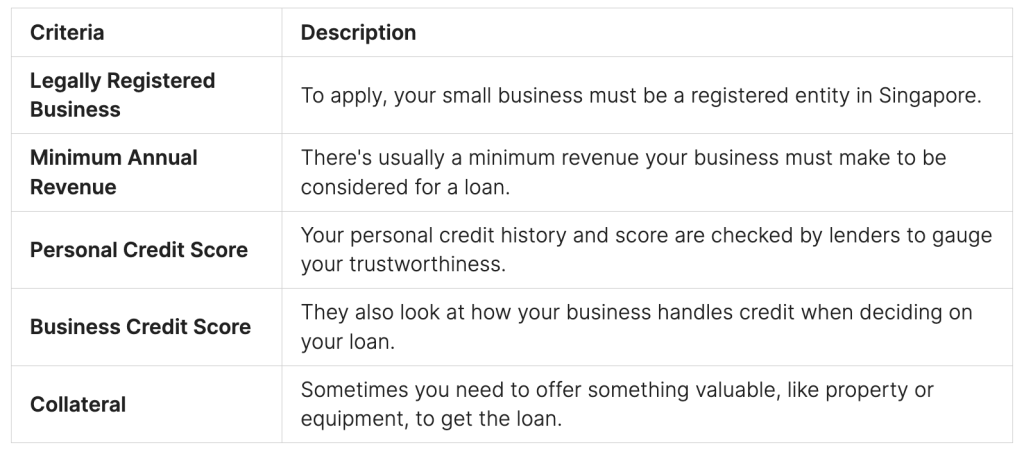

Lender-Specific Criteria

In Singapore, different lenders have varied small business loan criteria. You usually need to have a legal business, meet certain revenue levels yearly, and have strong personal and business credit scores. They’ll look at your credit history, debt you owe, and if you have assets to back up the loan. According to recent data, the average small business loan amount in Singapore is SGD 100,000, with a typical repayment period of 3 to 5 years.

Your personal credit score and your business credit score are key. They help lenders decide if you qualify for a small business loan. Maintaining good credit for both you and your business boosts your loan approval chances. In Singapore, a good personal credit score typically ranges from 800 to 900, and businesses with credit scores above 750 are more likely to secure loans with favorable terms, usually evaluated over a period of the past 12 to 24 months.

Preparing Your Business Plan and Financial Projections

Lenders like Avis Credit will really look at your business plan and financial projections. They aim to see your small business’s chances of success and growth. Your plan should have a clear summary, an in-depth look at the market, and how you’ll edge out competitors. Include detailed financial projections and your reasons for them. A well-prepared plan can show you’re serious and boost your chance of getting a loan.

Executive Summary

The executive summary is key in your plan. It gives lenders a quick look at your company, what you offer, your market, and financial outlook. This part should shine a light on what makes your business stand out, your strong points, and growth chances. It’s all about clearly and attractively outlining your plan’s core.

Market Analysis and Strategies

Understanding your market is vital. Your plan must show you know the industry, who your customers are, and who you’re up against. Talk about the market’s size, how fast it’s growing, and how you fit in. Explain how you’ll attract customers over others, what makes your product different, and why your offer is the best choice.

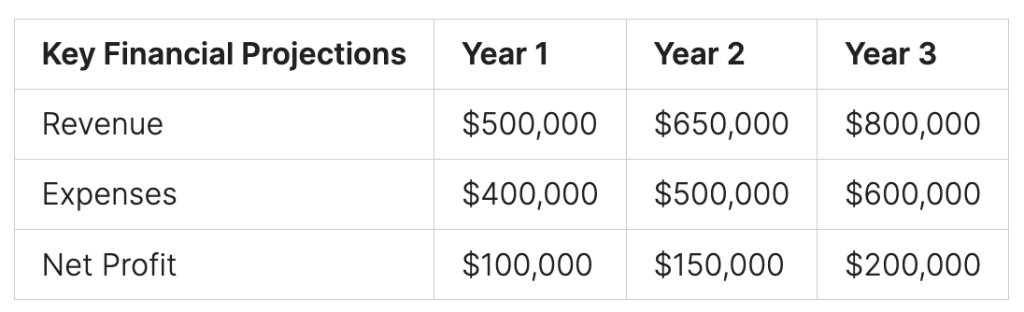

Financial Projections and Assumptions

Your financial projections are under a microscope. They should detail expected income, costs, cash flow, and profits. Make sure these numbers make sense and are based on real data. Show the reasons behind your projections. This shows you’re smart about finances and that your business has a solid plan.

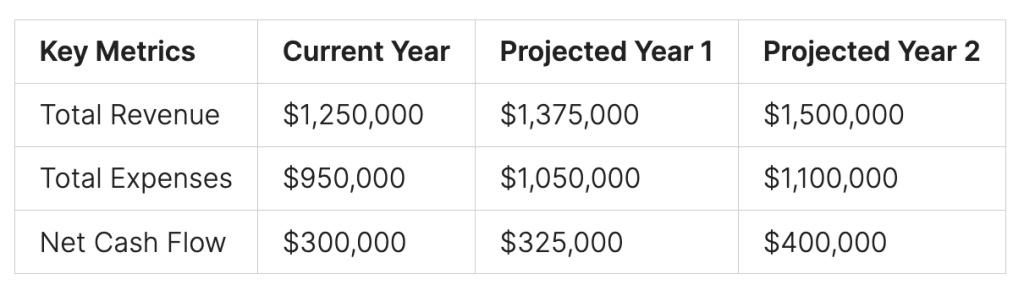

Demonstrating Sufficient Cash Flow

When getting a small business loan, lenders look at your cash flow. They check if your revenue covers your loan payments. They evaluate where your money comes from and how well you manage costs. Show you have steady cash flow. This will make lenders more likely to give you a loan.

Revenue Sources and Projections

Lenders want to know how your business makes money and if that money is steady. Talk about where your money comes from, like sales or fees. Also, share plans for future earnings. This includes things like market trends or new products. It shows you can make enough money to pay back the loan.

Expense Management and Cost Controls

Lenders will also look at how you spend money and keep costs low. They want to see that you know your costs and have ways to spend smarter. Share how you plan to keep costs under control. This proves your business is smart with money and ready to grow.

Building a Strong Credit History

Earning a good business credit history helps a lot when you apply for a loan in Singapore. Lenders carefully check your credit reports and scores to judge your creditworthiness. Clean credit history, on-time payments, and low debts boost your loan chances. In Singapore, businesses with a credit score above 750 are more likely to secure loans with favorable terms.

For small business owners, creating a strong credit profile is key. It includes adding your business to credit bureaus, keeping business and personal money separate, and checking your business credit reports often. Showing that you handle money well tells lenders they can trust you. According to recent data, 65% of small businesses in Singapore that regularly monitor their credit reports are approved for loans.

Remember, your personal credit matters for your business too. Lenders look at how you handle credit in all areas of your life. A strong personal credit score and little personal debt help your business loan application. In Singapore, a good personal credit score typically ranges from 800 to 900, and individuals with scores in this range have a 70% higher approval rate for business loans.

Working on a good credit history for your business and yourself is vital. It helps your business get the funds it needs to flourish. Managing your credit well and staying financially wise improve your loan chances in Singapore.

Collateral and Security for small business loan

In Singapore, when you want a small business loan, lenders will ask for collateral or security. This reduces their risk. Collateral can be things like real estate, equipment, or the items you sell.

It’s helpful to know what types of assets they accept and if you need a personal guarantee. With this knowledge, small business owners can apply smarter.

Types of Collateral Accepted

Lenders in Singapore accept many kinds of assets as collateral. This includes things like real estate, equipment, or even your business’s goods.

The value of the collateral and if it can be turned into cash matter to the lenders. So, it’s good for business owners to see which of their own assets could work as collateral. This could help them win loan approval.

Personal Guarantees

Besides collateral, lenders might ask for a personal guarantee. This is a commitment from the business owner to use their personal belongings as loan security. It shows how dedicated the owner is to their business’s success and taking on loan repayment responsibility.

Providing a personal guarantee could make getting a loan easier. Lenders feel more confident the loan will be paid back, no matter the business’s hardships. Owners should take the time to understand the details of a personal guarantee before agreeing.

Maintaining Accurate Financial Records

Keeping precise and recent financial records is key for a small business loan in Singapore. Lenders will examine your records closely. They want to understand your business’s financial situation. Showing you’re transparent and responsible can help you gain their trust. This might improve your chances of getting the loan.

Bookkeeping Best Practices

It’s crucial to have strong bookkeeping skills. This means you should record and sort all your transactions often. Also, keep your bank statements in line and manage invoices, receipts, and reports well. Using cloud-based accounting tools or hiring a bookkeeping expert can make this easier. They help keep your financial data correct and organized.

Tax Compliance

On top of keeping good financial records, meeting tax regulations is vital for loan readiness. Lenders will check that you’ve paid all your taxes, like corporate income tax and GST. Proving you’re good with taxes shows your business is stable and reliable.

Establishing Business Longevity and Experience

Lenders like to see small businesses with a strong history and deep knowledge of their field. Proof of your business’s long life and your expertise can help secure needed funding. It allows lenders to trust in your ability to grow and stay successful.

Years in Operation

Having a small business operate for many years shows it’s stable and tough. Lenders see these types of businesses as safer bets since they’ve faced many challenges. Showing off your business longevity lets lenders know your business can handle tough times and still succeed.

Industry Expertise

It’s also important to show you and your team know your industry well. Talking about what you know regarding trends and how business works can make lenders more confident in your success. Your industry expertise proves you can lead, make smart choices, and turn your plans into reality.

Applying for the Right Loan Type

When you’re after a small business loan in Singapore, looking at various loan types is key. You’ll find different options like term loans, lines of credit, and equipment financing. Each has its own unique traits and requirements, all of which impact how you finance your business. Picking a loan type that matches your needs and goals boosts your odds of getting approved. It also ensures the finance you get fits what your company needs.

Term Loans

Term loans are a go-to for many small businesses in Singapore. They provide a set amount of money that you pay back over an agreed-upon time, usually one to five years. You might use these loans to buy equipment, grow your business, or handle long-term projects. Lenders look into your business’s cash flow, what you can put up as collateral, and your credit standing. They use this info to set your interest rate and how you’ll pay the loan back.

Lines of Credit

A line of credit is like a pot of money you can dip into when you want and pay back over time. It’s great for smoothing out your cash flow, taking care of short-term bills, or covering day-to-day expenses. To get a line of credit, lenders make sure your business is doing well and can easily pay back what you borrow.

Equipment Financing

Need to buy specific equipment or machinery for your business? Equipment financing could be just what you’re looking for. Here, the equipment itself acts as the loan’s collateral. Lenders often cover the full cost of the equipment. This kind of loan keeps your cash free for other expenses while letting you get the tools you need for your business to grow.

| Loan Type | Key Features | Typical Use Cases |

|---|---|---|

| Term Loans |

|

|

| Lines of Credit |

|

|

| Equipment Financing |

|

|

Gathering Required Documentation

When you want a small business loan in Singapore, lenders ask for a lot of paperwork. They need this documentation to review your application. It includes personal and business tax returns, detailed financial statements, and certain legal documents for your business.

Avis Credit assists Singaporeans in gathering the necessary documentation, such as tax returns, financial statements, and legal documents, to streamline the small business loan application process.

Personal and Business Tax Returns

Lenders will check your past personal and business tax returns. They want to see your financial history and if you’ve paid taxes correctly. Giving the right tax returns shows you handle money well, an important part of getting a loan.

Financial Statements

You’ll also need to provide financial statements like balance sheets and cash flow statements. These papers show your business’s financial health — like where the money comes from and goes to. Clear and detailed financial statements can prove your business is stable and can repay the loan.

Legal Documents

Don’t forget about legal papers, like business registration and contracts. Lenders want to make sure your business is legal and follows the rules. Having all the correct legal documents makes your loan application smoother and shows you’re ready for assessment.

Gathering all the documents you need is key. It shows your business is honest, follows the rules, and is ready for growth. This preparation boosts your chance of loan approval and growing your business.

Small Business Loan in Singapore

In Singapore, small businesses can turn to many government assistance programs and local lender options. Government schemes like the SME Working Capital Loan and the Temporary Bridging Loan Program offer help. They give small business loans with good terms. It’s also wise to check out what local banks, online lenders, and other finance places offer. They can help you find the right small business loan for your needs.

Government Assistance Programs

The Singaporean government has set up programs to assist small businesses. For example, the SME Working Capital Loan offers competitive rates and easy payment terms. The Temporary Bridging Loan Program helps small businesses in rough economic times.

Local Lender Options

Other than government help, small businesses in Singapore can look to local lender options. These include local banks, online loans, and alternative finance sources. They tailor small business loan options to fit the needs of small businesses in the country.

Building a Strong Relationship with Lenders

Building a good lender relationship is key to getting a small business loan in Singapore. It’s important to be open and honest with your lenders. Share all details about your business and your finances. This helps in gaining their trust.

Communication and Transparency

Always keep in touch with your lender during the loan process. Update them on your business’s progress regularly. If they have questions, make sure to answer them. Be open about any financial difficulties you might face.

This kind of transparency shows you’re serious and can handle your business well. It strengthens the partnership between you and the lender.

Professionalism and Responsiveness

Show that you take your business seriously. This means being quick to reply to your lender’s messages. Always provide them with accurate and up-to-date info. Stay professional in all your dealings with them.

By proving your professionalism and dependability, you build trust. This trust can lead to your loan being approved. It also opens up doors for more financial help in the future.

Final Thought – Get Small Business Loan from Avis Credit

Avis Credit is one of the best money lenders in Singapore, offering tailored loans for small businesses. With over 99% of businesses in Singapore classified as small and medium enterprises (SMEs), finding the right financing is crucial. Avis Credit understands the unique needs of small business owners and provides competitive loan options to help your business grow.

Conclusion

To get a small business loan in Singapore, you must know what lenders look at. Make a strong business plan. Show your business has good cash flow and credit history. Bring all needed documents too. Doing this raises your chances of getting the funding you need to grow.

You should also check out government programs that help. And, it’s good to have a good relationship with lenders. With the right steps, you’ll be able to find the best small business loan. This will help your business move ahead.

Understanding what’s needed and how to get it from this article is vital. It helps your small business in Singapore’s busy market. Remember, a solid loan application shows you’ll manage the money wisely. This is crucial for getting the funds your business needs to expand.

FAQs About a Small Business Loan

1. What is a small business loan?

A small business loan is a financing option provided to small businesses to help them meet their operational needs, expand, or invest in new opportunities. These loans can be used for various purposes such as purchasing equipment, managing cash flow, or funding new projects.

2. How to get a small business loan from Avis Credit?

To get a small business loan from Avis Credit, start by ensuring your business meets their eligibility criteria, including having a good credit score and steady cash flow. Gather the necessary documentation, such as tax returns, financial statements, and legal business documents. Submit your application to Avis Credit, who will review your financial health and business plan to determine loan approval.

3. How does a small business loan work?

A small business loan provides businesses with a lump sum of money that must be repaid over a specified period, typically with interest. The repayment terms, including interest rates and duration, are agreed upon at the loan’s inception. Businesses use the loan for various needs and make regular payments according to the loan agreement until the debt is fully repaid.