About 50% of new businesses in Singapore find getting financial help the toughest in their early years. Knowing the right paths for a business loan for a new company is key to a startup’s success. This article will show you important hints and info for getting the funding you need.

We’ll cover what you need to know about startup business loans, the steps to qualify, and what applying involves. With our help, you’ll understand the foundations of loan options and how to meet the requirements. This way, you can be ready to secure the finances for your startup.

Understanding the Basics of Business Loans for Startups

For many entrepreneurs, getting business loans for startups is vital for starting their businesses. These loans give the money needed to start, buy equipment, and grow early on. It’s key to know the business loan basics to make the right moves.

Startups can get different types of business loans to fit their needs. It’s important to know about interest rates, how long you have to pay back, and when you need to pay. This helps you make smart choices. Also, knowing why these loans are so useful gives you a better idea of their value.

- Interest Rates: Typically, these are determined based on the risk profile of the business and the current economic environment.

- Loan Terms: These can vary from short-term loans (a few months) to long-term loans (up to several years).

- Repayment Schedules: Options might include monthly, quarterly, or sometimes balloon payments at the end of the term.

Business loans for startups are crucial because they help new businesses grow. Startups may not have enough to back up their loans or a long credit history. This makes it hard to get traditional loans. Special startup loans fill this gap, giving the needed funds.

Knowing these basics is a great start to finding the money a startup needs. This helps navigate the finance world and get the right support for success.

Eligibility Criteria for New Company Business Loans

Getting a business loan in Singapore for new companies has its hurdles. They must know the eligibility criteria for business loans. This knowledge is key for startups wanting to boost their funding chances. We will cover the most important business loan requirements and what Financial institutions need from candidates.

The main points of the eligibility criteria for business loans focus on credit scores and financial past. These show lenders you can handle and pay back the loan. Normally, a good history of managing money and a high credit score are needed. But, new businesses might lack a long financial history. In such cases, the personal financial past of the owners is also crucial.

- Credit Score: A high score enhances your loan approval odds. It proves to lenders you’re reliable and can pay back the money.

- Financial Statements: Reports like balance sheets and cash flow are key to showing the financial health of your business.

- Collateral: Some loans might need assets, like real estate, to secure the loan.

A good business loan requirement often ignored is the business plan. Lenders use it to judge your business’s future success. A detailed plan should describe your business goals and include market insights and financial forecasts. This showcases to lenders your plans for success and loan repayment.

Lenders also weigh the risks tied to new companies. Since these businesses don’t have a long history, lenders look at the management team’s expertise, the unique business idea, and its market position. These aspects help them decide if your business can thrive in the marketplace.

Bottom line, fulfilling the eligibility criteria for business loans demands more than just applying. It calls for understanding lender expectations and presenting your company well. A top credit score, full financial records, suitable collateral, and a solid business plan are crucial in showing your business is a good loan candidate.

Types of Business Loans Available for New Companies

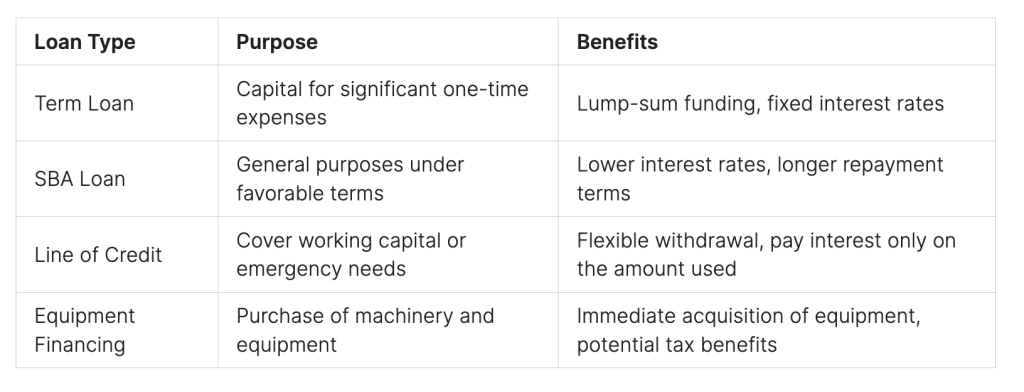

Finding the right types of business loans is very important for a new business. It helps it grow and stay financially healthy. Singapore has many business loan options for startups to choose from. We will explore the main types to guide your choice.

- Term Loans: These give a large sum upfront. Businesses pay it back with interest over time. They are good for startups that need lots of money at the start.

- SBA Loans: They are supported by the Small Business Administration. These loans have good terms, lower interest, and longer payback time. They are helpful for startups that meet the requirements.

- Lines of Credit: Lines of credit let businesses borrow money up to a certain limit. It is a flexible way to handle costs as they come.

- Equipment Financing: Solely for buying business equipment, this loan covers up to 100% of the cost. Businesses pay it back as they use the equipment.

Each type of business loan meets different needs. Some are for big investments, others for keeping up with everyday expenses. Knowing about each option helps you make the right financial choice for your startup.

Looking into these business loan options for startups helps entrepreneurs start strong. It gives them the financial backing they need to grow. This sets the stage for success in the future.

Business Loan for New Company: Step-by-Step Application Process

To get a business loan for new company, knowing how to move through the steps is key. It’s crucial for new businesses to be on point. This means really understanding what each step needs and getting ready well. This can majorly boost your chance of getting the loan you need.

- Preparation of Necessary Documentation: Start by collecting important paperwork. You’ll need financial statements, business plans, and proof of collateral. Make sure everything is correct and recent. This will help speed things up.

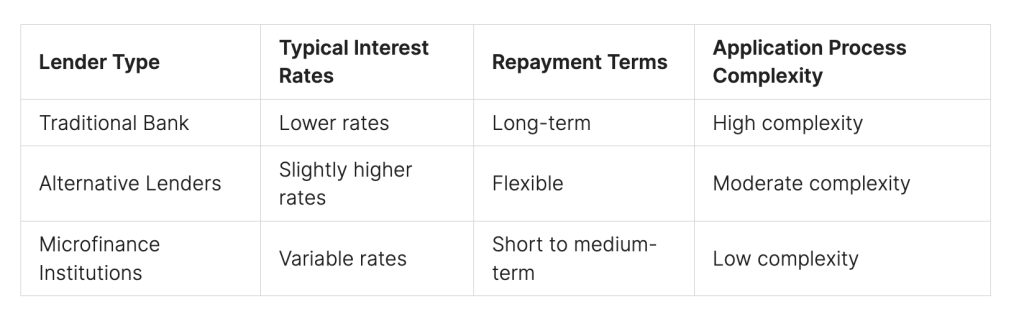

- Research Potential Lenders: Look into different banks and financial bodies. Find ones that fit your business type and size. Don’t just look at banks – explore other places that could lend money too.

- Submission of Application: Have you chosen your lender? Now, go ahead and send in your application with all the needed documents. Check your application thoroughly to prevent any issues or missing details.

- Follow-up and Negotiations: After you apply, stay in contact with your lender. Get ready to talk about the loan terms, like interest and how you’ll pay back the money.

- Approval and Loan Disbursement: If your loan gets approved, carefully read through the loan terms. Once you agree, the money will be sent to your account.

Picking the right place to get your loan is just as important as preparing. Here’s a brief look at what to think about when picking a lender:

Getting a business loan involves a lot of planning and being detail-oriented. Stick to the steps advised here. Also, be smart when looking at different lenders. This will up your chances of getting a loan that works well for your business.

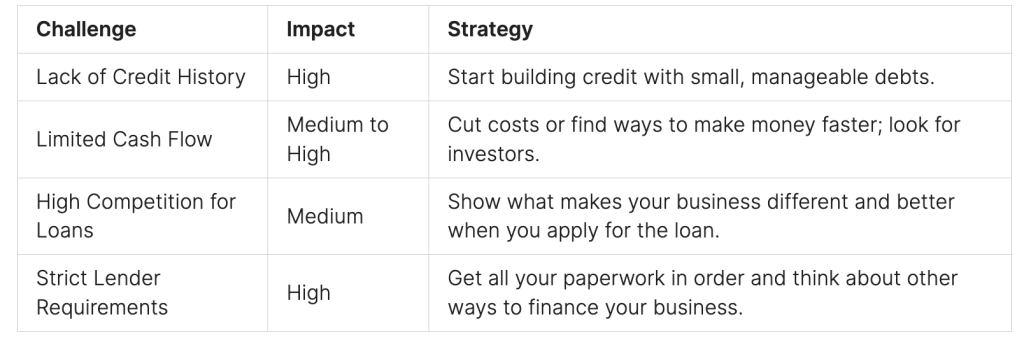

Common Challenges and How to Overcome Them

Getting a business loan in Singapore for a new company can be hard. Building a good credit history is important, but it’s tough when you’re just starting. Showing you can pay back what you owe is also a challenge.

This article will give you tips on how to tackle these loan hurdles. With this advice, you can boost your chances of getting the loan you need.

Strategies for Overcoming Common Loan Challenges:

- Build a Strong Business Plan: Focus on financial goals that make sense and show how you’ll make money.

- Enhance Your Credit Profile: Using short-term business loans or credit cards can help you build a better credit score.

- Secure Collateral: Sometimes, having something to put up for the loan can help make up for a short credit history.

- Explore Alternative Lenders: Look into lenders who might have different, more startup-friendly options.

Knowing what you’re up against and getting ready is half the battle. armed with our advice for overcoming loan barriers, you can boost your chance of loan success. This means more possibility of growing and keeping your business running.

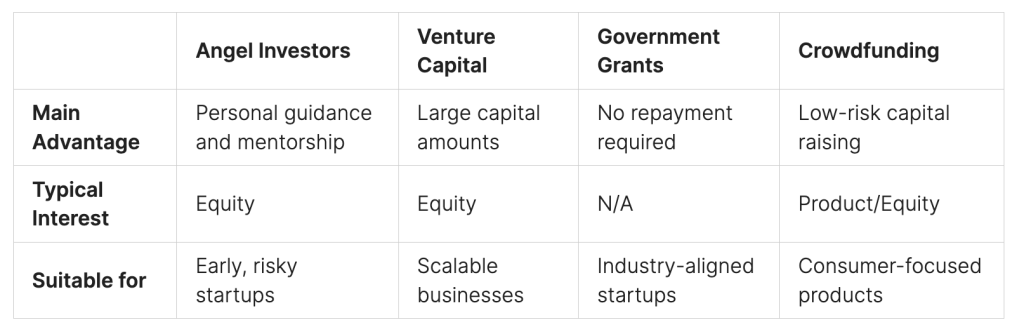

Financing Options Beyond Traditional Business Loans

Many startups use traditional business loans for their initial capital. It’s smart to look at alternative financing options. Doing this can open doors to more funds and more flexibility. This is especially good for new and creative companies in Singapore.

- Angel Investors: They give money to startups in return for a piece of the company or a promise to be paid back later.

- Venture Capital: These are companies that invest money from lots of people into new and growing small businesses.

- Government Grants and Subsidies: These are funds given by the government that don’t have to be paid back. They aim to help specific areas or goals.

- Crowdfunding: This means collecting small amounts of money from many people over the internet.

Each alternative financing option brings its own advantages. It’s important to know what they are. This knowledge helps you pick the best one for your startup.

For Singapore’s startups, these strategies can mean more money and better partnerships. It’s key to choose wisely. Think about your business’s stage, area, and what it needs most from funding.

Conclusion

This guide showed that getting a business loan for new company in Singapore is not easy. It requires careful planning and knowing how loans work. Getting to know the basics and meeting the requirements well are key. This makes your application stronger.

Looking at other ways to finance your business is also crucial. There are many options, like venture capital and government grants. Exploring these can help you grow your business in different ways.

So, the key is to prepare well and consider all financing options. With the right plan, you can secure the funding you need. This funding is more than money. It’s a way to build your business dream into a real success.

FAQs- Business Loan for New Company

1. What types of business loans are available for startups in Singapore?

Startups can access Term Loans, SBA Loans, Lines of Credit, and Equipment Financing.

2. What are the main eligibility criteria for new company business loans in Singapore?

Eligibility criteria typically include a strong credit score, detailed financial statements, collateral, and a comprehensive business plan.

3. How do interest rates for startup business loans get determined?

Interest rates are usually based on the startup’s risk profile and the current economic environment.

4. What documents are necessary when applying for a business loan?

Key documents include financial statements, a business plan, and proof of collateral.

5. What are common challenges in obtaining a business loan for a new company, and how can they be overcome?

Common challenges include building credit and proving repayment capability. Overcoming these challenges can involve enhancing your credit profile through small loans or credit cards, preparing a strong business plan, and considering alternative lenders.