In Singapore’s booming real estate market, 80% of small businesses struggle with funding. Yet, not many dive into property business loans. Knowing the right steps can speed up your loan approval.

This can put you ahead in the competitive real estate game. Having quick access to loans can be crucial. It helps grab opportunities before they’re gone. We’ll show you how to smoothly get a property business loan. It could be your key to a lucrative investment.

Understanding Property Business Loans

Real estate financing, like business property loan types and commercial property financing, is crucial. It helps real estate businesses grow and sustain. This section explores how business loans for property help entrepreneurs. They use these loans to support their real estate activities.

What Is a Property Business Loan?

A property business loan is made for real estate business needs. It helps buy new property, fix up old ones, or pay off debts. These loans provide the money needed for real estate projects and goals.

Different Types of Loans for Business Property

Knowing the different financing for real estate ventures is key for smart decisions. We’ll look at common business property loan types:

- Commercial Mortgages: They are standard long-term loans backed by the property.

- Bridge Loans: These are short-term loans used until a long-term loan is in place.

- Mezzanine Financing: This mixes debt and equity financing. It lets lenders become equity owners if the loan isn’t paid, usually a secondary loan.

Benefits of Opting for a Property Loan for Business

Choosing the right commercial property financing brings many benefits. It helps manage cash better, expand or improve facilities, and increases return on investment. Property loans also allow businesses to quickly adapt in the fast-changing real estate world.

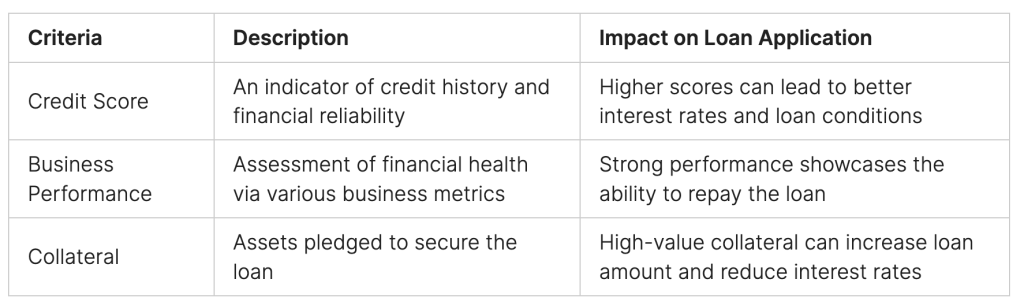

Eligibility Requirements for Property Business Loan Approval

Understanding the criteria for a business loan application in Singapore is crucial. Lenders look closely at your financial details to decide if you qualify. This includes checking your credit score, looking at how well your business is doing, and what you’re offering as collateral. Here’s a simple guide on what matters when applying for a loan.

Credit Score Considerations

Your credit score shows if you’re good with money and paying back debts. It’s very important for getting any kind of loan, including one for your business property. In Singapore, lenders pay a lot of attention to it because it shows how you’ve handled loans in the past and if you’re likely to pay back new ones.

Business Performance Metrics

Knowing if your business is doing well is key for lenders. They look at your financial reports, future money plans, and profits to make sure your business is solid. They also consider if your business has a strong position in the market and a good business plan. Both these things show if your business can last long term.

The Role of Collateral in Loan Approval

Collateral is super important for getting a business property loan. It’s like a safety promise to lenders in case you can’t pay back the loan. What you offer as collateral and its value can affect your loan’s terms. Make sure you know how lenders figure out what your collateral is worth. It should meet their standards of risk.

Preparing Your Application for a Business Property Loan

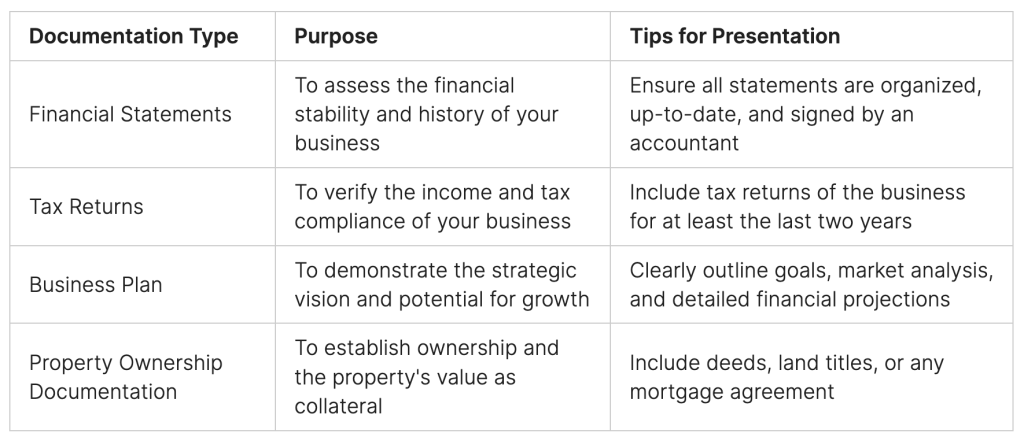

To get a business property loan, you need a strong plan. Start by putting together a solid application. This includes gathering your financial records and creating a detailed business plan. This approach will make your application stand out to lenders.

Gathering necessary documentation

The right documents are key for loan approval. You’ll need financial statements, tax returns, and proof of property ownership, among others. These documents help lenders analyze your business’s health and the risk they take by lending to you.

Creating a Strong Business Plan

A business plan is more than just a requirement—it’s a tool to sway lenders. It should outline your business vision, include a market analysis, and offer a financial forecast. This plan shows how you will use the loan to grow your business and fit it into your strategy.

Tips for a Compelling Loan Proposal

Making your loan proposal appealing is crucial. Here are some key tips:

- Highlight your repayment strategy: Stress on your plan to repay the loan.

- Address potential risks: Show that you’re ready to handle any risks.

- Demonstrate growth potential: Lenders prefer to invest in businesses that are likely to grow.

A strong financial base convinces lenders you’re creditworthy. To better your loan approval chances, manage your finances well. This means keeping a steady cash flow, minimizing debts, and boosting profits. Regularly checking your financial statements and improving operations shows lenders your business is a safe bet.

Improving Credit Scores Before Applying

Your credit score plays a big part in getting approved. To improve your score, pay off debts and avoid new credit checks. Fixing any mistakes on your credit report also helps. A better credit score can get you better loan terms. This is key for your business’s financial future.

Pitching the Business Growth Potential

Lenders look for businesses with a promising future. Show them your growth plans with research and solid projections. Explain how the loan will help you expand and increase profits. This shows you’re focused on giving the lender a good return and building a lasting partnership.

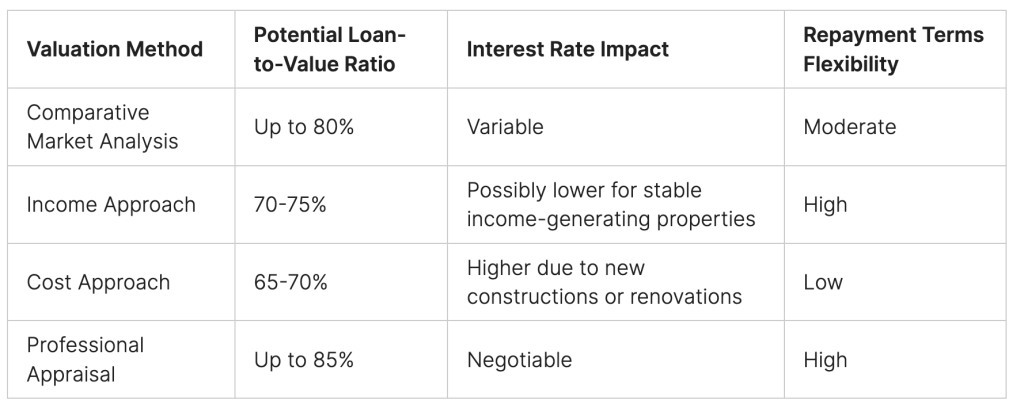

The Importance of Property Valuation in Business Loan Applications

An accurate property valuation is crucial when applying for loans. It greatly influences your financing terms and success. Lenders in Singapore view property valuation as essential. It affects the credit amount they offer.

Valuation Methods and Their Impact on Loan Terms

Different valuation methods can produce different property values. Knowing the method used is important. It influences your loan’s terms, like interest rates and repayment conditions. A conservative estimate may make lending conditions stricter. A higher valuation can lead to better loan terms.

How to Present Your Property for Valuation

Preparing your property for valuation is key. Highlight its best features and fix any issues. Ensure any renovations follow current regulations. Proper preparations can help you get a higher valuation.

Understanding Appraisal Reports

Reviewing the appraisal report carefully is essential. It’s more than just the final value. Understanding why the property was valued at that figure is crucial. This knowledge can help in loan negotiations.

Conclusion

Our journey in understanding how to secure property financing in Singapore has come to an end. We’ve learned how being prepared and knowing your strategy can help you get a business loan. This journey has shown us the importance of having a solid plan for property investment.

A well-prepared application, knowing the rules, and having a valuable property are key. They’re not just tips; they are crucial for getting a loan in Singapore’s tough market.

By using the tactics we talked about, you’re ready to improve your chances of getting a property loan for business. A strong application that shows good financial records, a smart business plan, and a thorough appraisal report helps a lot. It’s the little details and thinking ahead that put your property business on the road to growth.

Using strategies that are based on evidence and carefully looking at your business’s finances will make your funding quest stronger. It doesn’t matter if you’re starting to build, buying a historic building, or growing your real estate space. The aim is to use these insights for a thriving property business.

Applying these principles will guide you through Singapore’s property market. Let this advice help you navigate the loan process with knowledge and skill.

FAQs – Property Business Loan Secrets

How to get a business loan to buy property?

To secure a business loan for purchasing property, start by gathering your financial records and creating a solid business plan to present to lenders. Research various lenders, including banks and non-traditional financing options like “Avis Credit”, a reputable money lender in Singapore. Tailor your application to meet the lender’s criteria, highlighting your business’s stability and growth potential.

Can you get a business loan to buy property?

Yes, you can get a business loan to buy property, particularly if it’s for investment or operational purposes. Lenders, such as “Avis Credit,” offer specialized loans designed for business owners aiming to invest in real estate, ensuring you have the financial support needed to grow your business through property acquisition.